In today’s financial landscape, loans play a crucial role in helping individuals and businesses achieve their goals. Whether it’s buying a home, starting a business, or covering unexpected expenses, loans provide the necessary funds when savings fall short. This article will delve into the different types of loans, their purposes, and essential considerations for borrowers.

Types of Loans

1. Personal Loans

Kiirlaenud are versatile and can be used for various purposes, from consolidating debt to financing a wedding or vacation. These loans are typically unsecured, meaning they don’t require collateral. Lenders assess borrowers’ creditworthiness based on their credit score and income. Interest rates for personal loans can vary widely depending on the borrower’s credit profile and the lender’s policies.

2. Mortgage Loans

Mortgage loans are specifically designed for purchasing real estate. They come in two primary forms: fixed-rate mortgages and adjustable-rate mortgages (ARMs). Fixed-rate mortgages have a constant interest rate throughout the loan term, providing predictable monthly payments. ARMs, on the other hand, have variable interest rates that may change periodically. Mortgage loans usually require collateral, with the purchased property serving as security for the loan.

3. Auto Loans

Autolaenud help individuals finance the purchase of a vehicle. These loans can be obtained through banks, credit unions, or directly from car dealerships. Like mortgage loans, auto loans are secured, with the vehicle itself acting as collateral. The interest rates for auto loans depend on factors such as the borrower’s credit score, the loan term, and the vehicle’s age.

4. Student Loans

Student loans are designed to help students cover the costs of higher education. There are two main types: federal student loans and private student loans. Federal loans, funded by the government, often come with lower interest rates and more flexible repayment options. Private student loans, offered by banks and other financial institutions, typically have higher interest rates and fewer borrower protections.

Purposes of Loans

1. Debt Consolidation

Many borrowers use personal loans to consolidate high-interest debt into a single, more manageable payment. This strategy can simplify finances and potentially lower the overall interest rate, saving money over time.

2. Home Improvement

Homeowners often take out loans to fund renovations or repairs. Home improvement loans can increase the property’s value and enhance living conditions, making them a popular choice for those looking to invest in their homes.

3. Major Purchases

Loans are commonly used to finance significant expenses such as buying a car, funding a wedding, or taking a dream vacation. Spreading the cost over time with a loan can make these large purchases more affordable.

4. Business Ventures

Entrepreneurs frequently rely on loans to start or expand their businesses. Business loans provide the necessary capital for purchasing inventory, hiring staff, and covering operational expenses.

Essential Considerations for Borrowers

1. Interest Rates

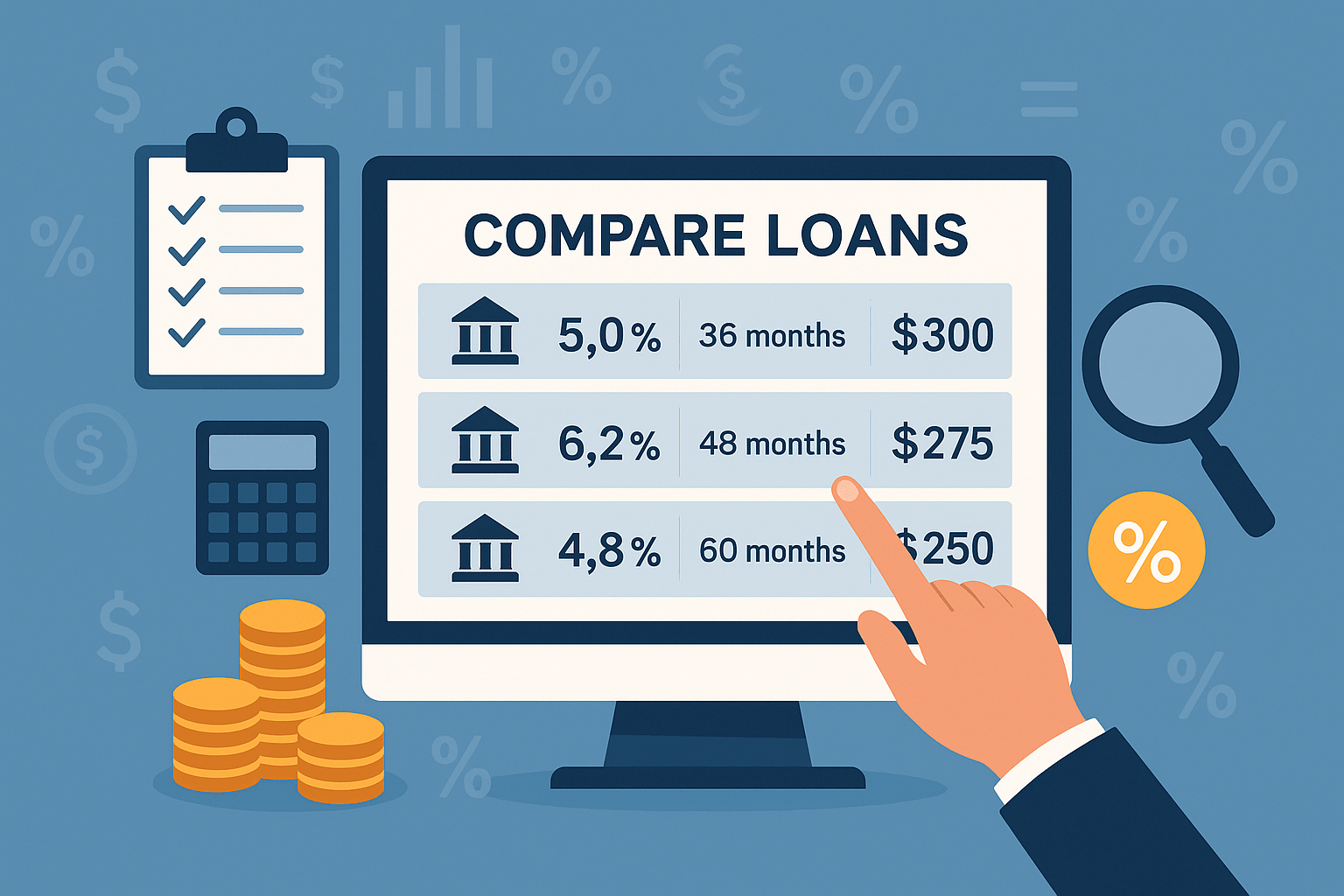

Interest rates significantly impact the overall cost of a loan. Borrowers should compare rates from different lenders and consider whether a fixed or variable rate is more suitable for their situation.

2. Repayment Terms

Understanding the repayment terms, including the loan duration and monthly payment amount, is crucial. Longer terms may result in lower monthly payments but can increase the total interest paid over the life of the loan.

3. Fees and Penalties

Some loans come with origination fees, prepayment penalties, or late payment charges. Borrowers should be aware of these potential costs and factor them into their decision-making process.

4. Credit Score

A borrower’s credit score plays a vital role in loan approval and the interest rates offered. Maintaining a good credit score by paying bills on time and managing debt responsibly can improve loan prospects.

Conclusion

Loans are powerful financial tools that can help individuals and businesses achieve their goals. By understanding the different types of loans, their purposes, and the essential considerations for borrowing, individuals can make informed decisions and manage their finances more effectively. Whether it’s for personal needs, education, or business ventures, loans provide the necessary support to turn aspirations into reality. For more info visit: https://kiirlaenuekspert.ee/