In today’s digital world, managing financial choices has become both simpler and more overwhelming. With a wide variety of loans available—ranging from personal and car loans to mortgages and business financing—consumers often struggle to identify which option suits their needs best. Loan comparison platforms have stepped in to make this process easier, allowing users to review lenders, interest rates, and loan conditions in one place. These tools offer clarity and convenience, helping borrowers make smarter choices and often save money.

What Are Loan Comparison Sites?

Platforms like https://kiirlaenud24.ee/ collect loan offers from multiple lenders and display them side by side in an easy-to-read format. Instead of browsing numerous bank websites or contacting financial institutions individually, users can enter basic information—such as the desired loan amount, the purpose of the loan, and their credit profile—and receive personalized offers in seconds. These platforms usually feature both traditional banks and non-bank lenders, giving borrowers a broad view of their options.

How They Work

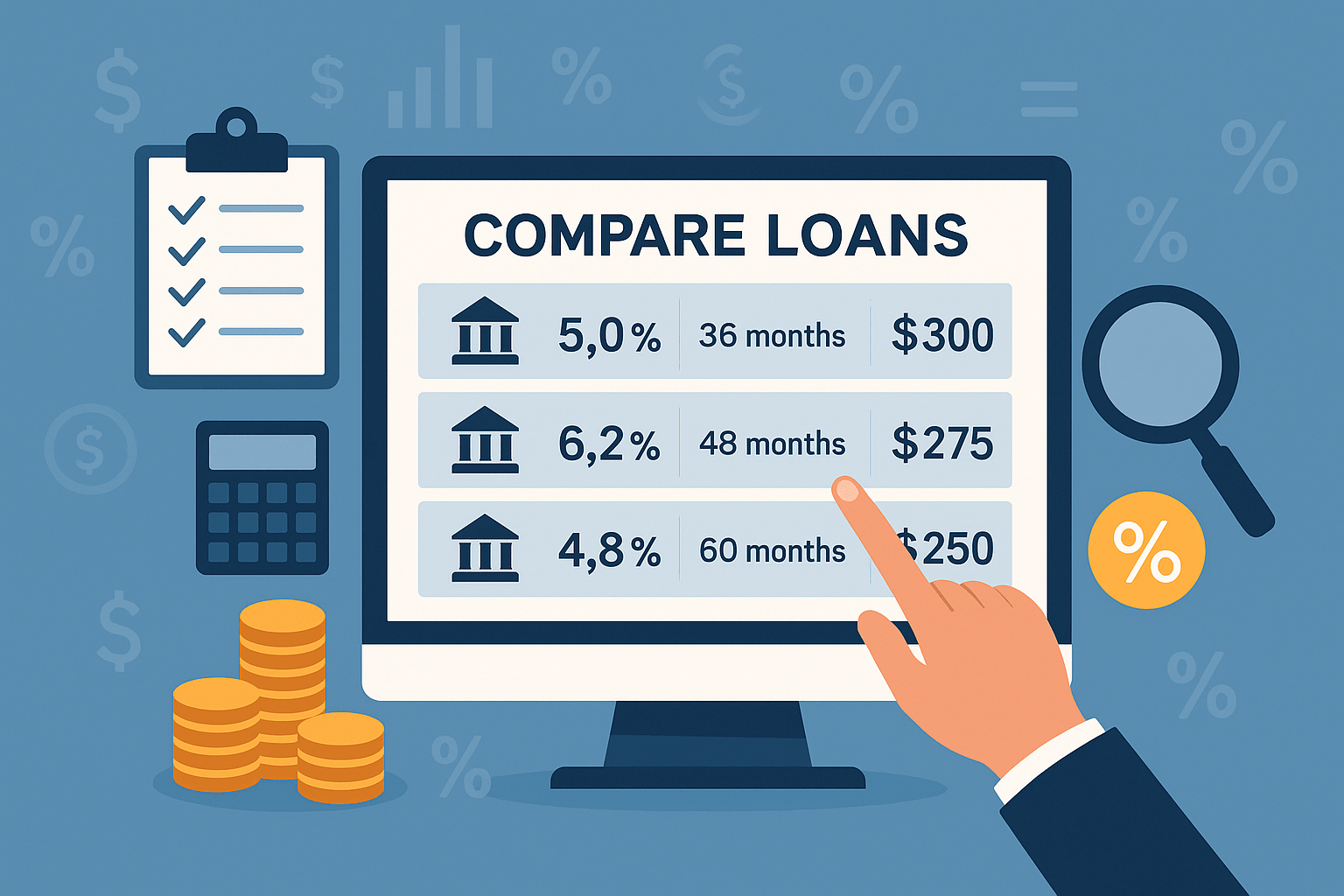

Using a comparison site typically starts with filling out a short online form. The platform uses the details provided—sometimes supported by a soft credit check—to match users with relevant loan offers. The results are then shown in a list or comparison table that includes essential information like interest rates, APRs, repayment periods, estimated monthly payments, and any additional fees. Many sites also allow further filtering based on loan category, lender ratings, or special features such as flexible repayment terms.

It’s worth noting that comparison sites do not issue loans themselves. They act as mediators, connecting borrowers with lenders. After choosing a suitable offer, users are redirected to the lender’s website to finalize the application.

Benefits of Loan Comparison Platforms

The biggest advantage these platforms provide is transparency. By clearly showing multiple offers side by side, they help consumers look past marketing claims and identify hidden costs. This openness often encourages lenders to stay competitive, which can lead to better terms for borrowers.

Time and cost savings are another strong benefit. Comparing loan offers manually can be tedious and time-consuming, while a comparison platform can deliver results instantly. Many sites also allow users to check their eligibility without harming their credit score, making the research process safer and more flexible.

Platforms like Kiirlaenud24 frequently include educational tools as well—such as articles, loan calculators, and expert guidance. These resources help users understand important concepts like fixed vs. variable rates or how credit scores influence borrowing options.

Potential Drawbacks

Despite their usefulness, comparison sites do have limitations. Some may highlight sponsored offers, meaning certain lenders pay for better visibility, which can affect the objectivity of results. Not every lender participates in comparison platforms either, so users may still miss exclusive or local deals. Additionally, sharing personal information on unreliable websites can raise privacy concerns, so choosing reputable platforms with strong data protection is essential.

Conclusion

Loan comparison websites have changed the way people search for financing. By blending technology with transparency and user-friendly design, they make it easier to confidently choose the right loan. Still, borrowers should use these tools wisely—reviewing fine print, verifying the platform’s credibility, and ensuring they understand all terms before committing. When used carefully, these sites can turn a complicated loan search into a streamlined and informed financial decision.